Outlook

Financial Outlook for 2019

2019 will be a transition year for Pandora, and the financial outlook will be significantly impacted by the actions taken in Programme NOW.

Changing guidance metrics to organic growth and ebit margin

To strengthen performance management and better reflect where shareholder value is created, Pandora changes its revenue guidance metric from total revenue growth in local currency to organic revenue growth (which excludes all impacts from forward integration and M&A activities). Pandora will also change its profitability metric to EBIT margin (from EBITDA margin) thereby sharpening the focus on cash allocation and minimising fluctuations related to the new accounting standard for leases (IFRS 16) which is effective from 1 January 2019. As a rule of thumb, the EBIT margin will be around 0.3 percentage points higher going forward while the EBITDA margin will be around 4.5 percentage points higher due to IFRS 16.

Financial guidance for the full year of 2019

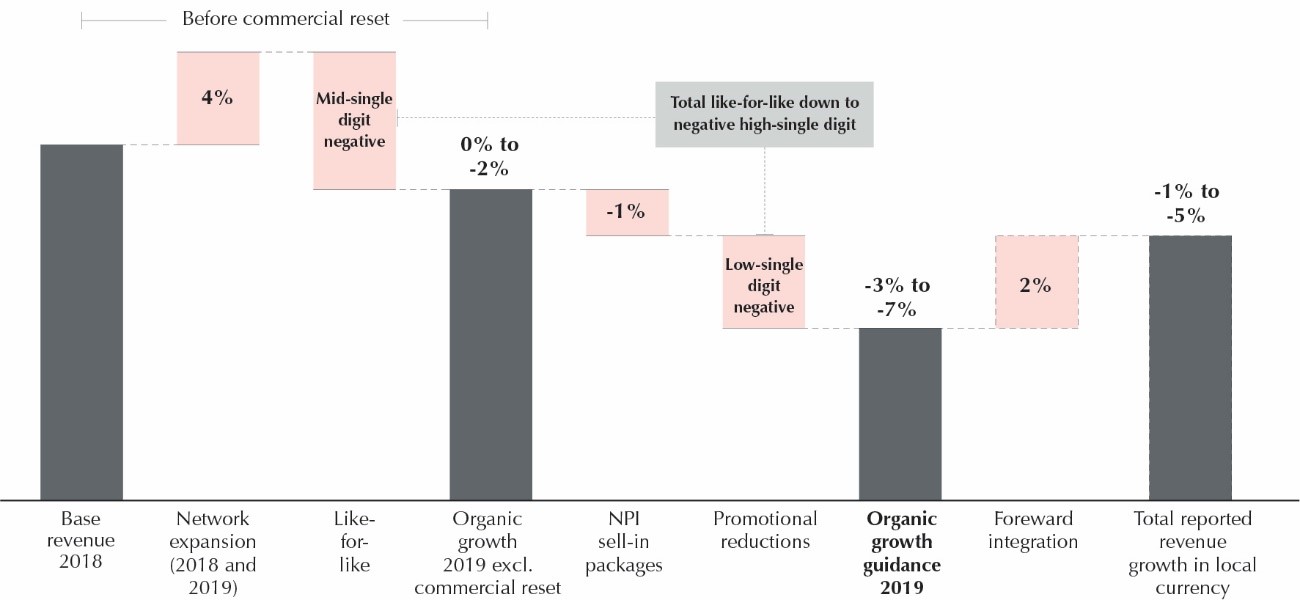

Organic revenue growth is expected to be in the range from -3% to -7%, which includes negative one-offs of 3-5 percentage points from the combined impact of the reduced sell-in packages (1 percentage point) and the decision to reduce promotional activities (2-4 percentage points).

The EBIT margin is expected to be between 26%-28% excluding restructuring costs of up to DKK 1.5 billion related to Programme NOW. For comparison, this corresponds to an EBITDA margin – before IFRS 16 impact – of 30.5%-32.5%. Including restructuring costs, the reported EBIT margin in 2019 is expected to be 20%-22%.

Building blocks to full year 2019 guidance

Organic growth guidance – building blocks

In 2019, Pandora expects to add around net 75 concept stores to the network. The store openings will mainly be in Latin America and China. The expansion of the network is expected to add around 4 percentage points of organic growth.

Forward integration – which is not included in organic growth – will positively impact total revenue growth by around 2 percentage points, which mainly includes acquisitions already completed in 2018, as well as Taiwan. Consequently total revenue growth in local currency is expected to be -1% to -5%.

Total like-for-like is expected to be negative mid-single digit before the impact from the commercial reset. It is expected that the initiatives in Programme NOW will mainly impact like-for-like from late 2019 and forward. Excluding the impact from the commercial reset, organic growth is expected to be between 0% and -2%. The NPI sell-in packages impact organic growth by around -1 percentage point while the reduction of promotions will impact total like-for-like and organic growth equally by negative 2-4 percentage points. In 2019, total reported like-for-like could therefore be down to negative high-single digit.

Ebit margin guidance – building blocks

The waterfall chart above outlines the most important building blocks of the EBIT margin development in 2019, supported by the following explanations:

In connection with the Q2 2018 announcement, Pandora stated the opportunity to improve the margin by 3 percentage points due to among others less forward integration, lapping wholesale destocking, cost reductions etc. That is still the case, except that wholesale inventories are expected to destock further and thus the margin improvement in 2019 from these factors is only 2 percentage points

“Other” includes margin impact from among others higher production time on new products, inflation etc.

Restructuring costs of around 6 percentage points (up to DKK 1.5 billion) in 2019, consists of:

The wholesale inventory buyback programme for selected markets will be impacting the EBIT margin negatively by around 2 percentage points

Around 4 percentage points will be related to programme execution. The majority of the restructuring costs will be recognised as OPEX

CAPEX for the year is expected to be in the range of DKK 1.2-1.5 billion. This includes investments in both Pandora’s own distribution network, IT and continued optimisation of the company’s crafting facilities in Thailand. CAPEX directly related to Programme NOW is expected to be around DKK 200 million and relates primarily to the investments in e-commerce and omnichannel features as well as commercial projects related to Reigniting a Passion for Pandora.

The effective tax rate in 2019 is expected to be around 22%-23%.

Assuming current exchange rates versus the Danish Krone, growth reported in DKK is expected to be 0-1 percentage point higher than in local currency.

Mid-term financial aspirations

All financial targets including all of the sub-components communicated in relation to the Capital Markets Day on 16 January 2018 are cancelled as a result of Programme NOW.

Pandora’s aspiration for the mid-term horizon is to deliver sustainable positive organic growth and industry-leading profitability. Organic growth will be driven by low- to mid-single digit total like-for-like growth combined with a continued controlled expansion of the store network in less penetrated areas.

[1] Organic growth is an alternative financial measure not defined by IFRS, see note 1.1 in the Annual Report 2018